Quick Summary

The commercial real estate (CRE) industry is at a turning point, with artificial intelligence (AI) and alternative data reshaping how professionals navigate a dynamic, transaction-driven market.

This blog explores how these technologies streamline operations, enhance decision-making, and unlock new opportunities. From core platform components to real-world case studies, we’ll dive into the transformative potential of AI and alternative data in CRE, addressing opportunities, challenges, and what lies ahead.

Commercial real estate opportunities are real if you know where to look.

Commercial real estate experienced years of elevated inflation, muted growth, and general uncertainty for a variety of reasons. Now it’s in the living moment. It’s time to commercialize in the market. Create new positions and explore new opportunities with an AI for commercial real estate platform powered with advanced tech and alternative data.

The market is more transaction-driven. It’s beyond just calling and closing deals. It’s about pricing, negotiation, legal compliance, proper management, and more.

An AI-powered real estate platform powers data, and traditional approaches together provide a significant edge beyond relying on a single technique. With the power of AI, you can granularly analyze and map demands, location, amenities, and more. For a property manager, CRE is real gold, handling everything from investment to management.

How can you dive into shaping the market? What are the opportunities you can nurture? What are the challenges you could mute? Let’s understand each step by step.

Diving into the AI Revolution in Commercial Real Estate – Opportunities and Challenges

The modern era, more advanced tech, and a faster market. There is something that can compound your efforts and multiply results: that’s AI. AI for commercial real estate market has redefined its vision, is shaping the future, and is building a legacy.

As a salesperson, business owner, or property developer, it can be overwhelming to keep up with the constant influx of new tasks. However, when AI and alternative data combine, they become a powerhouse far beyond mere tools.

It’s time to automate your real estate development, streamline operations, and build a foundation for success that drives higher ROI, closes deals faster, and gives you the knack to open new opportunities. With an AI-powered real estate platform, you gain a fresh perspective and a new vision, one that helps solve your business challenges and enables you to make decisions more efficiently, precisely, and profitably.

5 Out-of-the-Box Use Cases That AI Can Solve in Commercial Real Estate

These use cases go beyond simply commanding GPT to create a smart, quick sales deck. It’s scratching the whole commercial real estate ecosystem. From investment, property management, tenant sentiment analysis, reduced risk, operations, and more. AI’s impact can be seen in all dimensions.

▶️ AI-powered Commercial Property Valuation and Investment Analysis

Spotting opportunities before the market hits is a dream for many. AI for commercial real estate gives investors and developers the power to spot overlooked opportunities and guide them in capitalizing on them.

▶️ Personalized Property Recommendation for Investors and Tenants

An AI-powered real estate platform is highly touted for its ability to provide personalization. And this turns out to be a goldmine for investors and customers, offering them personalized recommendations and filtering in a more precise way just like the Affordable Living Solutions we developed for our client.

▶️Predictive Maintenance with IoT and Machine Learning

Preventive is okay. But being proactive is being smarter. This is where AI and IoT sensors can predict the red flags in properties, reducing maintenance costs by 20-30%.

▶️Data-driven Risk Management for CRE Portfolios

AI overlays key data, such as climate risks and tenant behavior, to proactively assess and mitigate risks, ensuring better asset protection and portfolio performance.

▶️ Predictive Modeling for CapEx and Renovation Scheduling

Biased forecast or data-driven forecast? As an investor or property owner, you want to make data-driven decisions. Using past historical maintenance logs, sensor data, and property conditions helps plan capital expenses and renovations precisely.

▶️ AI-powered Geo-spatial Simulation Platforms

Want a real-time view to shape smarter tenant placement strategies and optimize urban mobility? With AI-driven 3D GIS models, you can predict foot traffic, usage patterns, and access flows at different times, giving you a blueprint for using space more effectively and intelligently.

What are the Core Components of Commercial Real Estate and How AI Can Solve?

Commercial real estate isn’t about square footage; it has expanded beyond. It undertakes the entire lifecycle, from financial structures to market analysis, risk management, and more. Changing trends, evolving markets, sustainability, and hybrid uses demand real estate software development that’s automated and outperforms in a competitive market. It’s about someone who can handle everything and give insights at a click.

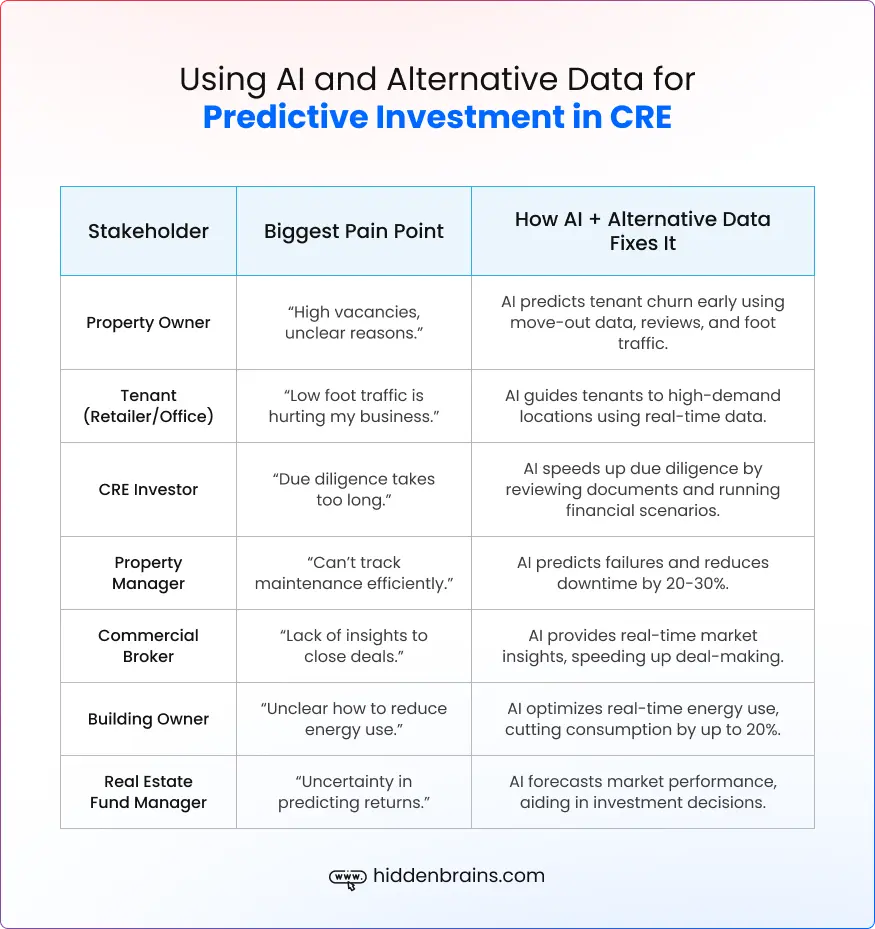

AI Solving Challenges in Commercial Real Estate

What CRE with AI and Alternative Data Can Solve

Artificial and alternative data can go hand in hand. They turn out to be powerful tools for making smart decisions and solving real-world problems. AI combined with CRE turns huge amounts of complex data into easy-to-digest insights. All you need to take action, make better decisions, and turn more profits and winning experiences.

Understanding Commercial Real Estate Platform with AI and Alternative Data

What are Real World Use Cases With CRE Powered by AI + Alternative Data?

The giants are leveraging predictive analytics in real estate. AI provides novel insights, improved decision-making, and automates daily tasks. Here are some of the examples.

- AI for Lease Abstraction

Using AI-powered natural language processing, we automate lease data extraction, key dates, financial terms, and obligations. Predictive analytics anticipate renewals, escalations, and compliance issues months ahead, enabling proactive management. This enhances tenant engagement while driving operational efficiency and revenue generation. - Property Valuation & Market Forecasting

AI and big data analytics enable more accurate property valuations and market forecasting capabilities. By analyzing diverse data sources, AI models provide precise property valuations and anticipate market shifts. This ultimately helps investors make better-informed decisions. - Integrated Data Analytics

AI-powered platforms integrate property data analytics with risk assessment and valuation tools for comprehensive insights. These systems combine ownership, valuation, transaction history, and risk data to offer enhanced decision-making capabilities. This serves both investors and lenders with actionable intelligence. - IoT-Based Smart Operations

IoT-based AI optimizes energy management and predictive maintenance across commercial properties. AI-driven smart sensors optimize warehouse operations, reduce energy costs, and proactively manage facility maintenance. This ensures efficient facility management and improved asset performance. - AI-Powered Brokerage Tools

AI assistants automate property marketing and research for commercial brokers, streamlining their workflows. These tools help brokers create property listings and seamlessly interact with research data. This boosts brokerage productivity and accelerates deal velocity. - Investment Research Platforms

AI-powered data platforms support investment research and lead generation for commercial real estate investors. These platforms offer AI-based property and ownership data, allowing investors to find off-market deals more efficiently. This data-driven approach enhances competitive intelligence gathering. - Automated Property Transactions

AI-powered platforms enable instant property pricing and market trend prediction for residential transactions. By analyzing market data and economic trends, these systems provide instant home offers. This streamlines property transactions and enhances the buying/selling experience.

Want to shape the future of real estate but unsure of your next steps? A 2-hour FREE consultation can help answer all your questions and provide you with clear insights on the path forward.

What’s the Future of CRE with AI and Alternative Data?

By 2030, the commercial real estate market will undergo a hybrid evolution. The market will be a balance of physical assets with digital overlays. AI and alternative data will drive more ways in the Proptech and Contech markets. It’s expected to grow to USD 9.11 trillion by 2033. Smart automation, predictive insights, tenant-centric services, sustainability, and more drive the future of CRE with AI and alternatives.

A prime example of this shift is a USA-based accessible living platform that has already attracted over 47.5K daily property visits. This highlights the potential of AI not only to increase customer engagement but also to unlock new revenue streams in the real estate space.

AI is already driving the commercial real estate market. Key trends to watch include:

- AI-powered Property Management & Smart Buildings

- Autonomous Leasing Assistants & Virtual Agents

- Predictive Analytics & Market Forecasting

- Digital Twins & Virtual Property Tours

- Increased Demand for Data Centers

- Sustainability and ESG Integration

- Ethical AI and Regulatory Compliance

- AI-driven Automation of Routine Tasks

- Expanded Use of Alternative Data

The commercial real estate market is rapidly evolving, and those embracing AI will be at the forefront of this transformation.

Frequently Asked Questions

How to build an AI-powered CRE platform?

To build an AI-powered Commercial Real Estate (CRE) platform, you’ll need to partner with a software development company that specializes in AI and real estate technology. AI for commercial real estate opens up numerous opportunities, such as smarter property management, automated valuation models, predictive analytics for investment, and enhanced decision-making through data-driven insights.

What bottlenecks can a CRE investment platform with alternative data solve?

It can resolve issues related to inaccurate property valuations, slow decision-making, and inefficient data management.

Can we add tools like ERP and CRM to the platform?

Absolutely! Integrating ERP, CRM, and other management tools can streamline operations, improve client interactions, and centralize business data for enhanced decision-making.

What is the cost to build a commercial real estate platform?

The cost typically ranges from $50,000 to $500,000, depending on features, complexity, and customization.

Can you integrate AI into my real estate platform?

Yes, we can integrate AI to enhance data analysis, automate workflows, and improve user experience.

Conclusion

Building a solution, brick by brick, requires a partner who goes beyond just applying off-the-shelf fixes. You need a partner capable of building everything from the ground up, including towering skyscrapers. Hidden Brains, with over 22 years of experience and an extensive portfolio in AI development, can elevate your capabilities, drive growth, and create long-term value.

Whether you need a digital roadmap to realign your strategy or custom real estate solutions that meet every requirement and serve as assets for future growth, we are here to help.

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg)

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg?1.0.0)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg?1.0.0)