Summary

Thinking about outsourcing a development team for your next fintech product or service, but not sure where to start?

Fintech is evolving fast—and outsourcing has become a powerful way to stay ahead. Whether you’re a startup building an MVP or a scale-up expanding your platform, this guide breaks down everything you need to know about fintech development outsourcing. From real-world benefits and common risks to proven use cases and expert best practices, we cover it all in simple, actionable language. You’ll also discover key trends, real success stories, and tips to choose the right partner. If you’re planning to build smarter, faster, and more securely—this guide is your perfect starting point.

According to McKinsey, fintech companies are on track to generate more revenue than traditional banks in the near future. The message is clear: the financial industry is rapidly going digital, and startups must adapt to survive and scale. One proven way to stay ahead? Fintech development outsourcing.

And it is no longer simply a cost-cutting measure. It is an intelligent approach to gaining access to worldwide technology talent, shorter time-to-market, and keeping up with the continuously evolving regulations. Even financially successful companies such as PayPal have outsourced aspects of their development in order to remain lean and focused on innovation.

For fintech startups and scale-ups, outsourcing can be the difference between building slowly and scaling smart.

In this complete guide, we will walk you through complete insights into the Fintech world.

So, let’s dive into how you can make fintech outsourcing work for your growth journey in 2026.

What is Fintech Development Outsourcing?

FinTech software outsourcing, in simple terms, means collaborating with an external team to develop or maintain your FinTech product. Instead of building a large in-house team, you partner with professionals who have the skills and tools needed to deliver results efficiently and effectively.

You can outsource almost everything:

Did you know?

Over 25% of SMEs globally now use fintech services to streamline operations, improve user experience, and stay competitive in a fast-changing market. These services span a wide range of solutions, including:

- Digital wallets – Enabling seamless and secure online transactions

- Core banking systems – Supporting essential financial operations and scalability

- RegTech (Regulatory Technology) – Simplifying compliance with ever-changing financial regulations

- InsurTech solutions – Modernizing insurance services with digital-first experiences

- Wealth management apps – Helping users manage investments and savings more efficiently

- AI-based fraud detection tools – Preventing suspicious activities with real-time, intelligent monitoring

Common Outsourcing Models For Fintech Development:

- Dedicated Team: A full-time remote team that works only on your product.

- Staff Augmentation: You temporarily hire developers or tech experts to fill specific skill gaps or scale your in-house team during high-demand periods. They work under your management and follow your internal processes.

- Managed Services: On its part, the outsourcing firm does development, testing and support.

Offshore, Nearshore, or Onshore—What’s the Difference?

- Offshore: A team of software developers located in a different country—often with significantly lower labor costs—who work exclusively on your project or as an extension of your in-house team, but remotely. While it’s a cost-effective model, it requires strong coordination due to time zones and cultural differences.

- Nearshore: Teams in nearby regions offer better time zone alignment and easier communication.

- Onshore: Teams in your own country—best for projects needing close oversight, though often more costly.

The key is to choose what fits your goals, budget, and product stage.

Current and Future Market Trends in FinTech Software Outsourcing

Fintech outsourcing is not a mere fad, but it is becoming central to the development of modern and financial products.

According to Statista, the IT outsourcing market is expected to reach $512.5 billion in 2024, and is projected to grow to $777.7 billion by 2028.

That is some serious growth, with a compound annual growth rate (CAGR) of almost 11%. A large portion of this, approximately 30 per cent, is contributed by the BFSI segment (banking, financial services, and insurance), implying that fintech may contribute more than $155 billion of that market this year, all by itself.

It is clear that an increasing number of financial firms are opting to outsource their technology, and with good reason at that.

And the best part? AI and machine learning are taking this trend to an even greater level. Fintech firms desire more intelligent fraud prevention, quicker decisions, and a more customized customer experience. It is where outsourcing companies with AI knowledge come in. As an illustration, Plaid has outsourced its AI-based fraud prevention, and it paid off.

That is a powerful indicator of what is to come. FinTech software outsourcing will remain a massive factor that will define the future of finance as the demand for smarter, faster, and more secure FinTech tools increases.

Why Companies Outsource Fintech Development in 2026?

It goes without saying that developing a fintech product is a big deal. You are not simply writing code. You are establishing something that must be safe, quick, scalable, and fully abiding by the regulations set within the industry. It requires much time, practice, and concentration.

It is where FinTech software outsourcing comes in as a smart move, not just for early-stage startups but even for large financial institutions. Why? Because a good FinTech outsourcing partner does more than deliver the product. They bring insights, solve problems before they arise, and support you long after the launch.

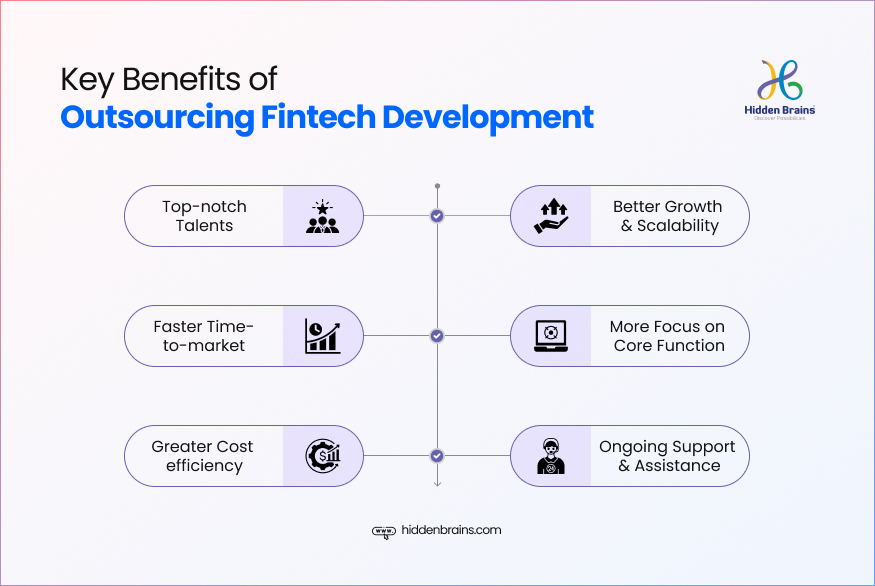

Let’s break down the real reasons companies choose fintech outsourcing:

1. Fintech Talent is Hard to Find

Technologies like blockchain, AI/ML, or secure payment systems need deep expertise. But there’s a global shortage of FinTech developers. Hiring in-house can take months and even then, you might struggle to find the right fit.

FinTech development outsourcing connects you with ready-to-go experts who already understand the fintech domain. You skip the hiring headache and hit the ground running.

2. Faster Time-to-market

Fintech is fast-moving. By the time you are slow to go live with your idea, it might be too old-fashioned. When you outsource, you deal with teams that have optimized processes, established workflows, and years of experience.

They are able to assist you in developing, testing, and releasing your product quicklyquicker compared to building an in-house team, literally starting with nothing.

3. More Cost-Efficient Than You Think

Hiring developers, designers, testers, and DevOps adds up quickly. Then there’s the cost of office space, tools, training, and employee benefits.

FinTech development outsourcing helps you cut all of that down. You’re not paying for full-time salaries or retention bonuses; you’re paying for outcomes. It makes a huge difference for startups trying to manage burn rates or scale efficiently.

4. Easier to Scale, Easier to Pivot

Need just a couple of backend developers now? Great. Want to scale to a full cross-functional team in 3 months? Even better.

FinTech outsourcing gives you that built-in flexibility. No need to worry about long hiring cycles or laying off people during slow phases. You scale up or down based on your roadmap, not your recruitment pipeline.

5. Stay Focused on What Matters Most

As a founder, you do not have much time for additional things. You want to spend your time raising funds, increasing the number of users, entering partnerships, and doing product strategy, not micromanaging sprints or reading code commits.

With a stable fintech offshore development team, you can focus on strategic growth while they handle the technical execution. Think of them as your reliable co-pilot in the product journey, ensuring smooth development and faster time-to-market.

6. Ongoing Support, Not Just One-time Delivery

The best outsourcing partners don’t disappear after the app goes live. They stick around to maintain, upgrade, and improve your platform. They’ll flag potential issues, recommend new features, and even guide you through scaling securely. You’re not just hiring developers. You’re building a long-term tech relationship.

Top Use Cases of Fintech Outsourcing

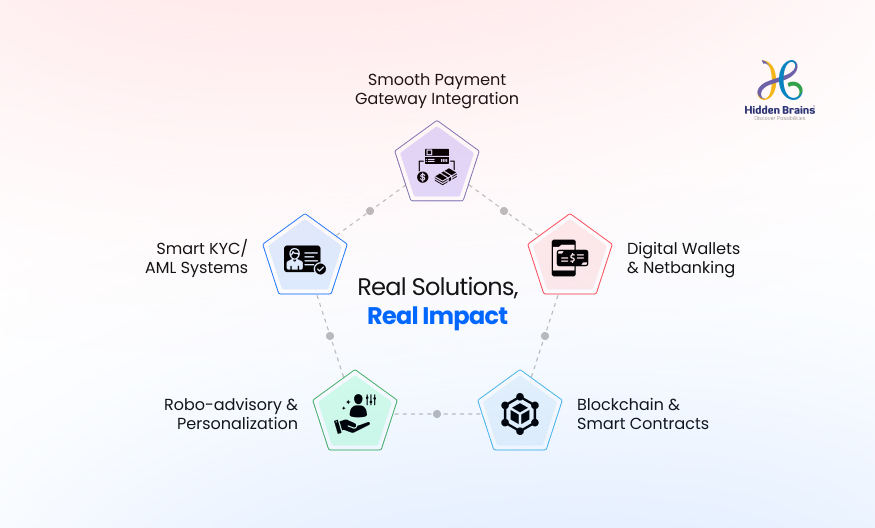

FinTech development outsourcing does not necessarily mean only writing backend code or creating user interface designs. Businesses are using it to create end-to-end, safe, and smart financial products that run daily purchases and lifetime investments.

FinTech software outsourcing can provide you with the technical muscle to move faster and smarter, whether you are introducing a new product or enhancing an existing product.

Here are some of the most common and impactful use cases:

Digital Wallets & Neobanking Apps

Outsourced teams help build intuitive, mobile-first platforms that allow users to manage money, make payments, and access banking services without visiting a branch.

KYC/AML Systems

Stay compliant with evolving regulations by outsourcing automated identity verification and anti-money laundering tools built with the latest security standards.

Payment Gateway Integration & Tokenization

From credit cards to UPI and crypto, outsourcing enables smooth, secure payment flows, with encryption and tokenization built in.

Blockchain & Smart Contracts

Ideal for lending, insurance, and decentralized finance (DeFi) products. Outsourced blockchain experts can build secure, tamper-proof smart contract systems.

Robo-advisory & Personal Finance Apps

Build AI-driven tools that help users manage investments, track spending, and plan financially without hiring an entire data science team in-house.

Also read: AI in Banking: Shaping the Future of the Finance Sector

Major Risks & Challenges Associated with FinTech Outsourcing

Whereas fintech outsourcing is quick, versatile, and allows access to talent all over the world, it does not lack its issues. To be able to make the most out of it, one must be aware of the dangers beforehand and train against them. What is the good news? Most of these risks would be managed by possessing the right partner and strategy.

Here are some common challenges to watch out for:

Regulatory and Compliance Risks

Fintech products have to adhere to restrictive financial laws. It can cause delays or legal problems when working with a partner who lacks full comprehension of the regulations in your region.

Security and Data Privacy Concerns

There are stakes involved in the processing of sensitive user data. When your outsourcing partner is not governed by good security measures, then you are prone to security breaches and loss of image.

Loss of Control and Communication Issues

Time zones, language gaps, and unclear roles can lead to misaligned expectations and missed deadlines.

Hidden and Unexpected Costs

What looks affordable upfront can turn costly if the scope isn’t well-defined. Always discuss pricing models and change policies clearly.

Post-launch Support and Maintenance

Some outsourcing firms focus only on delivery and vanish after going live. It makes ongoing updates and bug fixes harder if support terms aren’t defined early.

Cultural and Strategic Misalignment

Your goals may not align with the outsourcing partner’s priorities. It’s important to choose a team that understands your business vision and market.

How to Choose the Right Fintech Outsourcing Partner: Best Practices

It’s not just about coding skills—it’s about partnering with a team that understands the financial domain, regulatory complexity, rapid innovation cycles, and the importance of security and compliance

1. Look for Relevant Fintech Experience

Your ideal partner should have already worked on fintech projects like payment apps, lending platforms, robo-advisors, or blockchain systems. Ask to see their previous work. For example, if you’re building a digital wallet, a team that has handled PCI DSS-compliant projects before will be much more equipped to deliver.

2. Make Sure They Take Security and Compliance Seriously

In FinTech, data security is not a matter of negotiation. Select an offshore FinTech team familiar with laws such as GDPR, KYC/AML, or SOC 2. Questions to ask include how they manage sensitive data, the tools they apply to encryption, and how they control user access. If they are not able to answer these clearly, it is a red flag.

3. Test The Communication Style Early

Great code means nothing if the communication is poor. During initial meetings, notice how they respond to questions. Do they explain things clearly? Do they ask questions about your business goals? Tools like Slack, Jira, or Trello are signs that they have a system to keep you in the loop.

4. Choose Teams That Share Ideas, Not Just Updates

The best outsourcing partners won’t just do what you say. They’ll recommend better tools, faster workflows, and more innovative solutions. For example, they suggest a lighter framework for your MVP or highlight risks in your payment integration plan before they become real issues.

5. Think About Cultural Fit and Time Zone Alignment

It’s easier to work with people who understand your work culture and are available when you need them. A few overlapping work hours make collaboration smoother. If your startup values speed, find a partner who shares that mindset.

6. Ask About Long-term Support

Fintech products need updates, bug fixes, and feature rollouts over time. Make sure the team offers ongoing maintenance, not just a hand-off after launch. Clarify what happens after your app goes live, who handles what, and how quickly.

Also read: Web3 in Fintech: How Financial Institutions Are Getting Benefits

Fintech in Action: A Real Success Story

A leading fintech provider partnered with Hidden Brains to modernize its digital platform across web, mobile, and tablet. The result? Hidden Brains provides a 70% improvement in operational efficiency and a 40% faster user onboarding process. With secure login, real-time analytics, and seamless integration of payment and KYC APIs, the new system now serves thousands of users daily.

With secure login, real-time analytics, and seamless integration of payment and KYC APIs, the new system now serves thousands of users daily.

The scalable microservices architecture also set the stage for easy third-party plug-ins and future enhancements. Curious how the transformation unfolded? Explore the complete case study to see how innovative outsourcing helped this fintech firm level up its product, performance, and customer experience, without compromising on security or speed.

Looking for A FinTech Software Outsourcing Partner? Hidden Brains Is Here

Hidden Brains has 22+ years of experience in the field of FinTech software development, making it a reliable partner of fintech businesses worldwide. Whether that is secure payment systems or AI-powered financial products, we enable companies to understand their users, innovate with speed, and develop trust at scale.

You could be a startup or an enterprise; we exist to make your fintech idea come to life safely, effectively, and with sustainability. So, how can we fuel your development through clever outsourcing in fintech? Let us discuss it.

Frequently Asked Questions

Still have questions about fintech outsourcing? You’re not alone. Here are some of the most common queries we get, answered and clearly:

Is fintech outsourcing safe for handling sensitive data?

Yes, when you choose to work with a company that takes stringent security measures such as encryption and multi-factor authentication and adheres to regulatory standards such as GDPR, SOC 2, or PCI DSS.

How much does fintech software outsourcing cost?

Prices differ depending on complexity, scope, and region. Nevertheless, outsourcing FinTech software development typically ranges from USD 20,000 to USD 2,000,000+.

Can startups benefit from outsourcing too?

Absolutely. Startups may not be in a position to employ the entire team- outsourcing enables them to grow at a faster pace without sacrificing quality.

Will I lose control of my product?

Not when you have a clear partner to work with. Automatic updates, milestone follow-up, and teamwork features keep you posted all the time.

What if I need ongoing support after launch?

Most outsourcing partners will provide maintenance, updates, and technical support after launching as a long-term cooperation.

Final Words

Fintech outsourcing isn’t just a smart move; it’s a strategic advantage. With the right FinTech development outsourcing partner, you can build faster, scale smarter, and stay compliant without stretching your resources thin. As the digital finance space evolves, those who leverage expert outsourcing will lead the way forward.

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg)

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg?1.0.0)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg?1.0.0)