Summary

Predictive analytics is transforming real estate in 2025, turning massive data into smart, profitable decisions. From pricing homes accurately to spotting high-growth locations early, this technology helps developers, investors, and agents stay ahead in a competitive market. With real-world examples from top firms like CBRE, Zillow, and Redfin, plus insights on trends, benefits, challenges, and tools, this guide covers everything you need to know. Whether you’re planning a new project or optimizing existing assets, predictive analytics provides clarity, confidence, and competitive advantage. Dive in to see how data can unlock the future of real estate success.

Do you know that advanced platforms now study over 200 data points?

They look at satellite images, rental trends, and economic signals. All this to give real-time insights for better property investments.

The old way of planning real estate projects is gone. Calculating ROI with guesswork is over.

In the last five to seven years, AI has changed everything. Predictive analytics now powers every big decision in real estate.

It helps price homes right. Spot hot locations early. Attract buyers with smart ads.

No surprise that predictive analytics in commercial real estate will hit 34 billion dollars by 2030. It is growing at a 35 percent annual rate.

The future of real estate is clear. Data with real estate software solutions lead the way. Read the blog till the end to know everything about predictive analytics in real estate today.

How Predictive Analytics Works in Real Estate?

Do you know that in 2025, CBRE Group Inc., a leading Canadian commercial real estate developer, upgraded its location intelligence platform with predictive analytics?

This move transformed how they chose sites, priced properties, and managed risks.

Predictive analytics in real estate is not just about crunching numbers. It is about turning massive data into more thoughtful decisions.

Here is how it works.

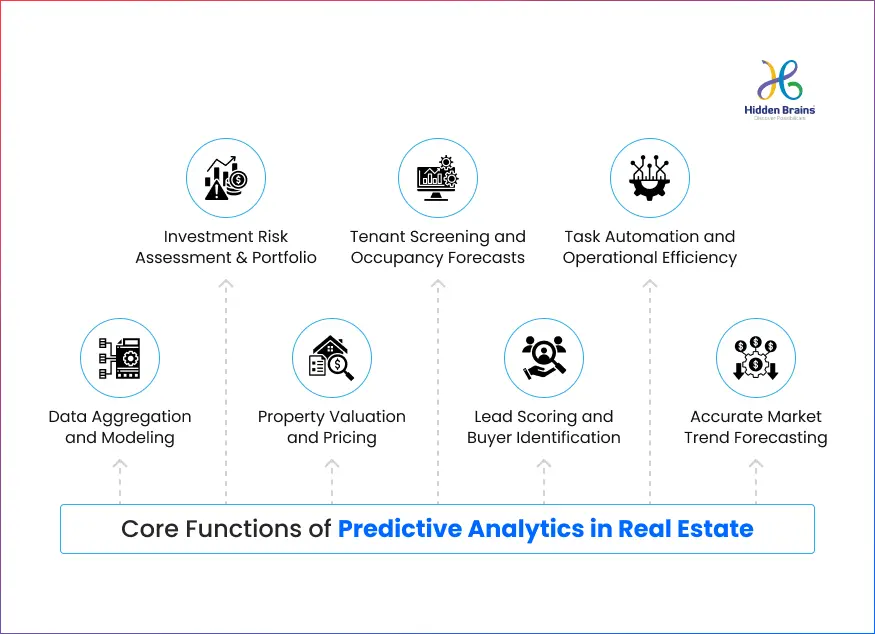

- Data Aggregation and Modeling

Cutting-edge predictive analytics tools gather data from sales records, rental trends, demographics, and even satellite images. Then it builds models to spot patterns. - Property Valuation and Pricing Optimization

It helps set accurate property prices based on demand, supply, and neighborhood trends. - Market Trend Forecasting

Developers can predict how markets will move and plan projects with confidence. - Lead Scoring and Buyer Identification

It identifies high-intent buyers so sales teams can focus on real prospects. - Investment Risk Assessment and Smart Portfolio Management

It flags risky investments and helps balance portfolios for steady returns. - Tenant Screening and Occupancy Forecasts

It predicts occupancy rates and screens tenants to reduce default risks - Task Automation and Operational Efficiency

It automates routine tasks so teams save time and cut costs

All these functions work together to make real estate decisions faster, more innovative, and more profitable. Here is a table for you to understand the crucial role of predictive analytics in real estate.

What Are the Different Types of Predictive Analytics Used in Real Estate?

Predictive analytics is not one single thing. It comes in different forms. Each type solves a specific problem for real estate developers, investors, and agents. Here are the main ones:

- Descriptive Predictive Analytics: Looks at past data to show what happened and why. Real estate teams use it to study old sales, rental patterns, and pricing history.

- Diagnostic Predictive Analytics: Goes a step further. It explains the reasons behind past results. For example, why did property prices drop in a specific neighborhood?

- Predictive Modeling: This is the core of real estate forecasting. It uses data from multiple sources to predict property demand, pricing, and ROI potential.

- Prescriptive Analytics: Does not just predict. It suggests the best next step. For instance, whether to hold, sell, or invest in a property.

- Real-Time Predictive Analytics: Processes data instantly. Perfect for competitive markets where timing can make or break a deal.

- Spatial Predictive Analytics: Uses geospatial data like maps and satellite images. Developers find the best locations for new projects using this.

- Behavioral Predictive Analytics: Analyzes consumer behavior like search trends and buyer interest. It helps agents target the right customers with the right properties.

Do you know? Accessible Living Solutions transformed the U.S. affordable housing landscape with innovative digital solutions, becoming the number 1 affordable housing solution in the USA.

Why Should You Invest in Predictive Analytics for Real Estate Software Solutions

Real estate today runs on data, not guesswork. Predictive analytics in commercial real estate turns that data into powerful insights for developers, investors, and property managers.

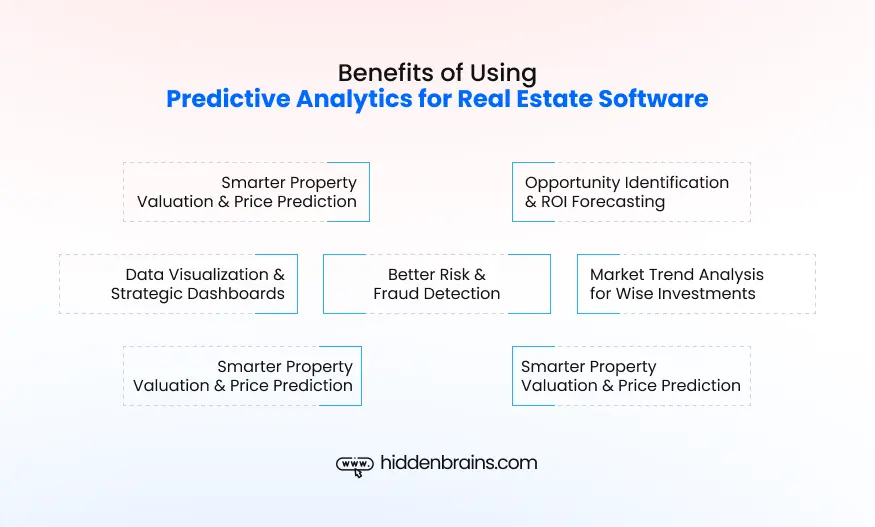

Here is why it is worth the investment

- Smarter Property Valuation and Price Prediction

No more pricing blind spots. Predictive analytics sets the right price using demand trends and market dynamics. - Opportunity Identification and ROI Forecasting

Spot promising locations early and forecast returns before putting in big money. - Market Trend Analysis for Wise Investments

See where the market is heading, confidently plan projects, and avoid slow-moving areas. - Better Risk and Fraud Detection

Predict potential risks or fraud patterns before they hurt your investments. - Data Visualization and Strategic Dashboards

Get clear dashboards for quick decisions instead of digging through complex reports. - Personalized Experiences and Recommendations

Offer buyers property suggestions that match their needs and budgets - Predictive Maintenance and Asset Management

Keep properties in top shape, predict issues before they become expensive repairs

Top 10 Real Estate Firms Leveraging Predictive Analytics in 2025

If you are a real estate developer still wondering whether predictive analytics is worth investing in your next software solution, these real-world examples might change your mind.

Here’s how the most prominent players in the industry are already using it to stay ahead.

- CBRE Group

CBRE leads the way with its upgraded Dimensions platform. 2025 it will combine aerial images, census data, and market trends. The result? Precise forecasts on property demand. It helps CBRE grab prime locations before competitors and optimize leasing strategies. - Zillow Group

Zillow’s famous Zestimate tool is now more innovative than ever. It crunches data from 110 million U.S. properties. With AI analyzing 900 data points per home, buyers and sellers instantly get accurate price predictions and market insights. - Opendoor

Opendoor simplifies home buying and selling with machine learning. It studies past sales, market behavior, and local dynamics. This helps set competitive prices and streamlines the iBuying process for faster transactions. - Compass

Compass uses predictive analytics to find homeowners likely to sell soon. Its CRM platform studies data patterns and market signals. Agents then focus on high-potential leads, boosting conversion rates. - Redfin

Redfin forecasts housing trends using AI-powered models. It checks search behavior, economic data, and sales records. Buyers and agents know precisely which neighborhoods are heating up. - JLL (Jones Lang LaSalle)

JLL relies on predictive analytics for smarter commercial investments. It evaluates tenant habits, property risks, and market volatility. Clients get precise advice on leasing strategies and asset management. - CoStar Group

CoStar brings predictive analytics to commercial and multifamily real estate. It combines rental trends, transaction data, and maps. Investors see high-ROI opportunities with easy visual tools like heat maps. - Keller Williams

Keller Williams uses SmartZip-powered predictive analytics to identify sellers. Its platform combines property details with consumer behavior. Agents target high-probability listings with remarkable accuracy. - Prologis

Prologis focuses on warehouses and logistics properties. It uses predictive analytics to forecast demand and pick strategic locations. Industrial real estate expansions are now data-driven, not guesswork. - Cushman & Wakefield

Cushman & Wakefield predicts tenant turnover and rental rates in advance. Its tools guide landlords in adjusting strategies before problems hit. Occupancy rates and revenues stay strong.

Key Trends Driving Predictive Analytics in Real Estate

The real estate sector is changing fast. Developers, investors, and agents are moving away from guesswork. Today, data and Custom AI solutions guide every big decision.

Here are the top trends driving predictive analytics adoption:

- Big Data Explosion – Massive data from property records, buyer behavior, IoT sensors, and social media fuels more intelligent forecasting.

- AI and Machine Learning – Advanced algorithms turn raw data into accurate price, demand, and ROI predictions.

- Geospatial Analytics – Satellite imagery and location data help identify high-growth neighborhoods and strategic project sites.

- PropTech Platforms – Easy-to-use predictive analytics tools make insights accessible even for mid-sized real estate firms.

- Real-Time Analytics – Cloud-powered platforms deliver instant insights for faster decisions in competitive markets.

- Personalization and Recommendations – Tailored property suggestions improve user experiences and buyer engagement.

- Risk and Fraud Detection – Predictive models flag suspicious patterns early to protect investments.

Together, these trends make predictive analytics a game-changer for real estate success.

Challenges in Using Predictive Analytics in Real Estate

Predictive analytics is changing how real estate choices are made, and specific challenges surround its introduction. Here are the main challenges:

- Data Quality Problems: Partial or inaccurate data may result in unreliable predictions and bad decisions.

- Expensive Implementation Costs: Advanced analytics applications and infrastructure can be costly.

- Absence of qualitative skills: There are numerous real estate teams without the skills to analyze and interpolate complex data models.

- Integration with Existing Systems: Integrating predictive analytics systems with past systems can be tedious and complex.

- Privacy and Compliance Risks: The processing of sensitive customer and property data should be conducted per high security standards and regulations.

How Hidden Brains Can Help

Hidden Brains has over 22 years of experience building software for real estate businesses. We help companies use the latest tools like predictive analytics and AI to make better property decisions.

We understand real estate needs like pricing, risk checks, and market trends. Our team builds simple, easy-to-use software that saves time and boosts profits.

Want to build smart real estate software? Let’s work together to make it happen!

Frequently Asked Questions

Predictive analytics is changing real estate fast, but many developers and investors still have questions before starting. Here are some simple answers to help you out:

1. What is predictive analytics in real estate?

It’s a way to use data, AI, and machine learning to predict property values, market trends, buyer behavior, and risks. It helps you make decisions based on facts, not guesswork.

2. How does predictive analytics help developers?

It gives accurate pricing, better site choices, early risk warnings, and ROI forecasts. Developers can plan projects smarter, reach the right buyers, and earn more profits.

3. Is it expensive to use predictive analytics?

Costs depend on how advanced the software is. But today, many platforms offer affordable options—even for mid-sized firms.

4. What data does it use?

It uses data from property records, economic indicators, satellite images, IoT sensors, sales history, and social media trends to predict outcomes.

5. Can it reduce investment risks?

Yes. It can spot risks early, warn about possible downturns, and suggest changes to protect your investments.

Conclusion

Predictive analytics is changing real estate fast. It turns data into clear insights so you can make smarter decisions, earn more, and cut risks. Developers, investors, and agents can stay ahead because it helps predict prices and market trends. With technology moving so quickly, using predictive analytics is no longer optional. It is the future of real estate, and the best time to start is now.

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg)

![Sales & Distribution [Oil & Gas] Sales & Distribution [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/sales_and_distribution-icon.74d08193.svg?1.0.0)

![Fluid Terminal Management [Oil & Gas] Fluid Terminal Management [Oil & Gas]](https://www.hiddenbrains.com/blog/wp-content/themes/blankslate/assets/images/fluid_terminal_management-icon.4b3a27a4.svg?1.0.0)